Standardized Format: E-invoices use a standardized JSON format designed by GSTN, ensuring consistency in data exchange.

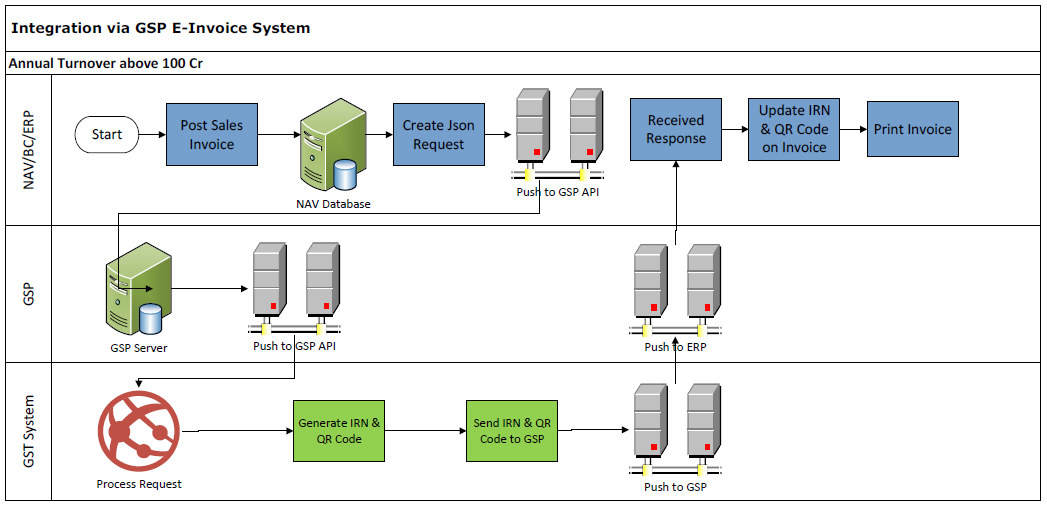

GST Suvidha Providers (GSPs): GSPs assist businesses in complying with GST regulations by providing platforms for invoice submission to the GST portal.

Invoice Reference Number (IRN): Each invoice, debit note, or credit note is assigned a unique IRN by the Invoice Registration Portal (IRP) using a hash generation algorithm.

QR Code & Digital Signature: A QR code containing the IRN and invoice details is generated, along with a digital signature for verification on the GST portal.

Automatic Reconciliation: E-invoicing enables automated reconciliation of GSTR-1 and GSTR-2A, reducing manual effort and errors.

Data Transmission: Data is exchanged directly from software to software, eliminating manual entry and reducing errors.

Digital Signature Requirement: A digital signature is required for e-invoices to authenticate and ensure data integrity.

Invoice Cancellation: E-invoices can be canceled within 24 hours, after which manual cancellation on the GST portal is possible before filing returns.

Electronic-invoicing Integration with Microsoft Dynamics 365

E-invoicing integration is the process of exchanging invoice documents between a supplier and a buyer in an integrated digital format. In this system, all B2B invoices are electronically submitted and verified through a designated portal.

Rules of E-Invoicing

- Applicable for businesses with a turnover exceeding 100 crores.

- Covers the following document types: B2B, B2G, Export through e-commerce operators, and Reverse charge transactions.

- Document types included under e-invoicing: Invoices, Debit Notes, and Credit Notes.

- Data transmission will occur directly from software to software; no manual submission option will be available.

Benefits of E-Invoicing

- The purchaser receives the IRN as soon as the invoice is generated by the supplier.

- Helps prevent errors, losses, and fraud.

- Enhances relationships between suppliers and customers.

- Automates the creation of GSTR-1 and GSTR-2A reconciliation.

- Enables QR code-based scanning.

- Provides a standardized reporting format across all organizations.

- Auto-generates data for tax filing purposes.

- A single document fulfills all statutory requirements, such as e-way bills

Key Points to Know About E-Invoicing

-

Data Transmission: Data is exchanged directly from software to software, eliminating manual entry and reducing errors.

-

Digital Signature Requirement: A digital signature is required for e-invoices to authenticate and ensure data integrity.

-

Invoice Cancellation: E-invoices can be canceled within 24 hours, after which manual cancellation on the GST portal is possible before filing returns.

Key Component of E-Invoicing integration

Standardized Format: E-invoices use a standardized JSON format designed by GSTN, ensuring consistency in data exchange.

GST Suvidha Providers (GSPs): GSPs assist businesses in complying with GST regulations by providing platforms for invoice submission to the GST portal.

Invoice Reference Number (IRN): Each invoice, debit note, or credit note is assigned a unique IRN by the Invoice Registration Portal (IRP) using a hash generation algorithm.

QR Code & Digital Signature: A QR code containing the IRN and invoice details is generated, along with a digital signature for verification on the GST portal.

Automatic Reconciliation: E-invoicing enables automated reconciliation of GSTR-1 and GSTR-2A, reducing manual effort and errors.

Data Transmission: Data is exchanged directly from software to software, eliminating manual entry and reducing errors.

Digital Signature Requirement: A digital signature is required for e-invoices to authenticate and ensure data integrity.

Invoice Cancellation: E-invoices can be canceled within 24 hours, after which manual cancellation on the GST portal is possible before filing returns.