Business Central vs. Finance & Operations: Choosing the Right Dynamics ERP

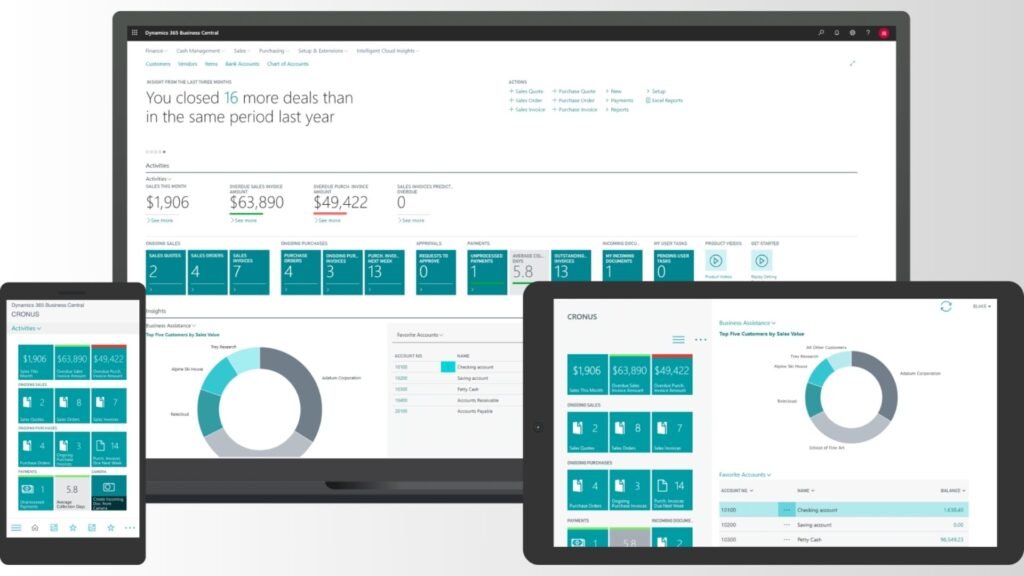

When it comes to digital transformation, businesses in the United States are increasingly investing in ERP (Enterprise Resource Planning) solutions to streamline operations, improve decision-making, and drive growth. Among Microsoft’s robust ERP offerings, two solutions stand out—Dynamics 365 Business Central and Dynamics 365 Finance & Operations (F&O). Choosing between these two platforms can be challenging. Both are powerful, cloud-based solutions designed to unify business processes, but they cater to different organizational sizes, industries, and complexities. To make the right choice, businesses must evaluate their goals, processes, and future scalability. This article provides a detailed comparison of Business Central and Finance & Operations, highlights their features, and explains how working with a trusted Microsoft Dynamics 365 partner in USA can help businesses successfully implement the right ERP solution. Why ERP Choice Matters for U.S. Businesses The right ERP is not just a technology investment—it’s a strategic decision that shapes how a business operates. A poorly chosen ERP can lead to inefficiencies, wasted investments, and employee frustration. On the other hand, selecting the right solution with expert ERP implementation services in USA ensures long-term scalability, compliance, and competitive advantage. Overview: Dynamics 365 Business Central Business Central is Microsoft’s ERP designed primarily for small to mid-sized businesses (SMBs). It evolved from Dynamics NAV and offers a streamlined, all-in-one solution that covers core business processes. Key Features of Business Central Ideal for: Overview: Dynamics 365 Finance & Operations Finance & Operations (F&O), also known as Dynamics 365 Finance and Dynamics 365 Supply Chain Management, is built for large enterprises and global organizations with complex operations. Key Features of Finance & Operations Ideal for: Business Central vs. Finance & Operations: A Feature Comparison Feature Business Central Finance & Operations Target Audience SMBs and mid-sized companies Large enterprises & multinational corporations Deployment Cloud-first (with some hybrid options) Cloud (Azure) Financials Strong, but focused on SMB needs Advanced financials with multi-company, global compliance Supply Chain Inventory & basic warehouse management Advanced supply chain with manufacturing, logistics, IoT integration Scalability Suitable for mid-market growth Enterprise-level scalability Cost Lower licensing and implementation cost Higher cost, but more advanced capabilities Implementation Timeline 2–6 months (faster rollout) 6–18 months (complex rollout) Customization Flexible, but lighter compared to F&O Highly customizable for large enterprises Integration Microsoft 365, Power Platform Microsoft 365, Power Platform, Azure AI, IoT Key Considerations When Choosing Between Business Central and Finance & Operations 1. Company Size & Complexity 2. Budget & Total Cost of Ownership (TCO) 3. Industry Requirements 4. Growth Plans Role of a Microsoft Dynamics 365 Partner in USA Choosing between Business Central and Finance & Operations is only the first step. To ensure a successful ERP journey, businesses need the expertise of a certified Microsoft Dynamics 365 partner in USA. How a Partner Helps: Working with an experienced partner reduces risk, ensures faster ROI, and aligns ERP investments with business goals. Microsoft Dynamics 365 Implementation in USA: What to Expect Whether you choose Business Central or Finance & Operations, the implementation journey is critical. Here’s what U.S. businesses can expect from professional Microsoft Dynamics 365 implementation in USA: This structured approach ensures businesses not only implement ERP but also maximize its value. Microsoft Dynamics Services in USA: Beyond Implementation ERP is not a one-time project; it’s an ongoing journey. That’s why companies need long-term Microsoft Dynamics services in USA to support their ERP ecosystem. Key Services Include: Partnering with experts ensures ERP evolves with your business, rather than becoming outdated. Real-World Example A mid-sized distribution company in Texas was struggling with QuickBooks and manual inventory tracking. They partnered with a Microsoft Dynamics 365 partner in USA and migrated to Business Central. Meanwhile, a global automotive manufacturer in Michigan needed a system to handle complex supply chains across multiple continents. By implementing Dynamics 365 Finance & Operations: This comparison illustrates how Business Central and F&O serve different organizational needs. Benefits of Choosing the Right ERP with Expert Support Conclusion Both Dynamics 365 Business Central and Dynamics 365 Finance & Operations are powerful ERP platforms—but they serve different needs. Business Central is best suited for small to mid-sized businesses seeking affordability and simplicity, while Finance & Operations is built for large enterprises with complex, global operations. To make the right choice, businesses must carefully evaluate size, industry requirements, and growth plans. Most importantly, partnering with an experienced Microsoft Dynamics 365 partner in USA ensures a smooth implementation and long-term ERP success. With the right guidance, Microsoft Dynamics 365 implementation in USA delivers not only streamlined operations but also strategic advantages that fuel business growth. Supported by expert Microsoft Dynamics services in USA and ERP implementation services in USA, companies can future-proof their operations and stay ahead in an increasingly competitive market. Frequently Asked Questions (FAQs) Q 1. What is the main difference between Business Central and Finance & Operations?Ans: Business Central is tailored for SMBs with simpler operations, while Finance & Operations is designed for large enterprises with complex global operations. Q 2. Which ERP is more cost-effective for U.S. businesses?Ans: Business Central has lower licensing and faster implementation costs, making it more cost-effective for SMBs. Q 3. How long does a Dynamics 365 implementation in USA take?Ans: Business Central implementations can take 2–6 months, while Finance & Operations may take 6–18 months due to complexity. Q 4. Why should I work with a Microsoft Dynamics 365 partner in USA?Ans: A partner provides expertise in ERP implementation, customization, training, and ongoing support—ensuring higher success rates and ROI. Q 5. What industries benefit most from Finance & Operations?Ans: Industries such as manufacturing, logistics, retail, and large-scale finance benefit the most due to F&O’s advanced capabilities.

Business Central vs. Finance & Operations: Choosing the Right Dynamics ERP Read More »